Google pay

UX testing for one of Australia’s ‘big 4’ banks when introducing Google pay.

Brief

Enhance awareness of Google pay and enrolment.

Evaluate the activation components of Google pay model for mobile customers using the client’s website.

Deliverables

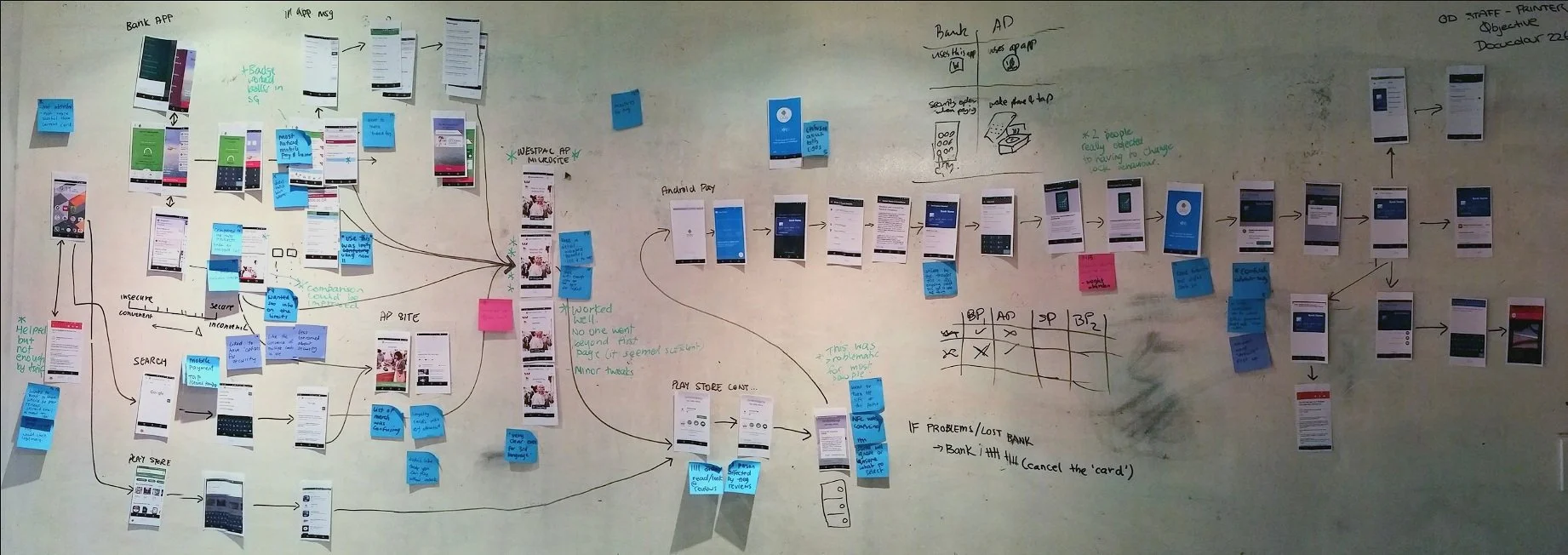

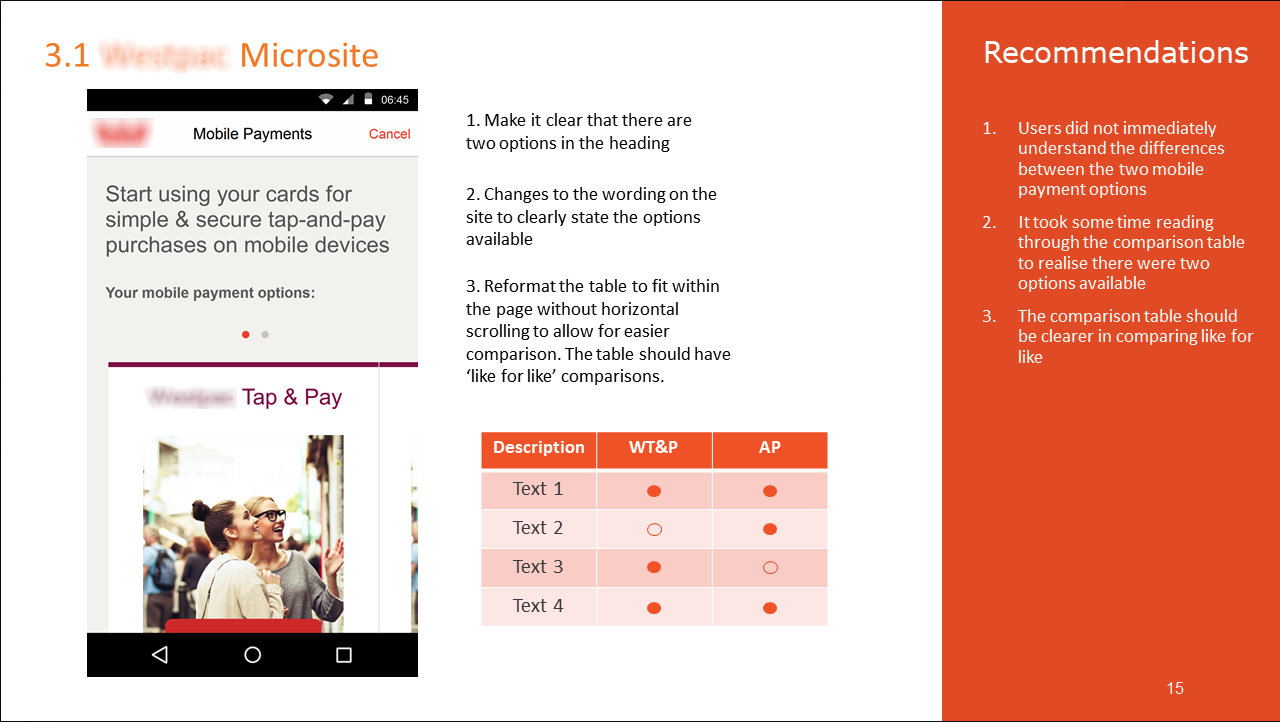

Validation to the high fidelity approach to adoption: microsite screens, in-app adoption cues, targeted vs untargeted adoption cues

Further conceptual exploration into a failed payment flow: who is relationship with? What to do when issues are encounted?

My role

Lead researcher and testing moderator.

Approach

2 x 6 participant rounds of moderated testing, 12 x 1hr sessions

NPS and SUS questionnaire data also gathered.

Key results

Once participants were convinced to try Google pay: setup and install was simple.

Enough technical information appeared to be supplied to give participants the confidence to install the app.

Participants trusted their bank more than they trusted a technology company.

Difficulties

Advising the client that user uptake of the new service appeared to be low unless they took more of the responsibility in the relationship with the customer than the 3rd party.

Confusion over what happens when transaction issues arise and lost/stolen cards and phones.

Participants confused by overly technical language in App setup.

Remedies

Capitalise on the trusting relationship with the bank and stand behind the new payment channel.

Take on more ownership of the process and customer service akin to lost/stolen physical cards in current practice.

Included their customer quotes and footage in the presentation back to the client, encouraged key client stakeholders to witness some of the testing so the message was repeated by a 'friendly' (staff member).

Use more reassuring language and imagery to enhance impression of security.

Results

Client was not expecting the low confidence in adoption that was observed, however was thankful to have a number of ways to improve their product presentation and increase customer confidence and therefore adoption of the new payment method.

Reflections

Despite common sentiment of “being taken advantage of” by Australia’s banks, participants placed a surprising degree of trust in their bank over the security of a technology company. It was my recommendation that the bank capitalise on this trust relationship and provide additional reassurance regarding lost/stolen cards & phones to customers when promoting this product.